-

-

- Transfer Credit

- Online Learning

- Events

-

-

-

- Academic Services

- Course and Program Information

- Student Aid

-

-

-

Berkeley Global

Office Closures

We are closed during the following:

- Labor Day

- Veterans Day

- Thanksgiving (Last Thursday and Friday in November)

- Winter Holidays (Late December to early January)

- Martin Luther King Jr. Day

- Presidents' Day

- Cesar Chavez Day (Last Friday in March)

- Memorial Day

- Juneteenth Freedom Day (Observed on June 19)

- Fourth of July

Library Use

After the start of a semester-length Extension course, you can purchase a $25 6-month borrowing card for UC Berkeley Libraries. The borrowing card allows you to access licensed electronic resources, such as journals and databases, and the ability to check out up to 20 books at a time.

To set up an account, visit the UC Berkeley Library Privileges Desk at the Doe Library, Floor 1, with proof of your current registration and a government-issued photo ID. Alternatively, you can email privdesk@library.berkeley.edu and provide the following:

- Proof of current registration

- Full legal name and preferred name

- Email address

- Mailing address

- Telephone number

Renting Our Classrooms

Extension classrooms are available for rent for meetings and training sessions on a space-available basis weekdays, 8:30 am–9 pm (Pacific Time). Three weeks' advance notice is required and the renter must provide a certificate of insurance. Please email extension-rentals@berkeley.edu for more information.

Questions?

Please email customer service comments and feedback to extension@berkeley.edu.

Education Tax Credit

To determine eligibility for Taxpayer Relief Act of 1997, contact the Internal Revenue Service (IRS), a tax consultant or an accountant. The IRS Form 1098-T Tuition Statement is used to assist the taxpayer in determining eligibility for an educational tax credit and/or deduction. The University of California has contracted with the TAB Service Company (TSC) to electronically produce your IRS Form 1098-T Tuition Statement and make it available for you to download it offline. UC Berkeley Extension issues you a Form 1098-T if you had at least one reportable transaction (such as a tuition payment or a program application/registration fee) during the calendar year.

The IRS requires all educational institutions to request students to provide a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). This must be completed before year end:

- Log in to your student account to review or update this information.

- Go to “My Profile”.

- Under “Personal Information Section” enter your SSN.

- Press “Save” at the bottom of the screen.

If you had a reportable transaction during the calendar year and your email is up to date on your student account, you will receive an email notification from UC Berkeley Extension by Jan. 31 every year when your Form 1098-T is available online. Be sure your spam filter does not capture email from UC Berkeley Extension email extension@berkeley.edu. To access your 1098-T online:

- Go to www.tsc1098t.com, or call (888) 220-2540.

- If you do not receive a Form 1098-T notification by email by Jan. 31, log in to www.tsc1098t.com and enter the following information to login:

- Enter the Site ID: 5 digit school code assigned by Tab Service = 11554

- User Name: Student ID that starts with X

- Password: Last 4 digits of your SSN

If you are an international student without an SSN or have otherwise not provided your SSN to UC Berkeley Extension, the temporary password will be 0000. Submitting this temporary password in the login screen will initiate a password reset process with your email on file.

For security reasons, you will then be prompted to change your password. Enter your old password (last four digits of your SSN) and then enter a new password. The new password must be 7 characters and contain at least one numeric character, one upper case letter and one special character.

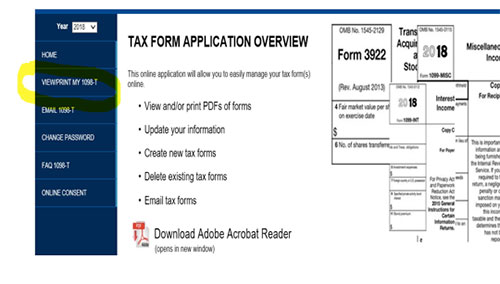

Once you login to the website, you can access and print your 1098-T form by selecting “View/Print My 1098-T” from the menu on the left side of the screen.

If you need assistance, please call (888) 220-2540.

For additional information about the Taxpayer Relief Act of 1997, Education Tax Credits and IRS Form 1098-T, please refer to the UC Berkeley Student Billing Services website or the IRS website.

Record Retention Policy

UC Berkeley Extension adheres to the Records Retention Policy as defined and determined by the University of California Office of the President.

Clery Act Disclosure

In compliance with the Jeanne Clery Disclosure of Campus Security Policy and Campus Crime Statistics Act, the University of California, Berkeley publishes an Annual Security and Fire Safety Report (ASFSR). This report includes current campus security policies plus crime and fire statistics for the previous three calendar years. It also contains contact information for various campus and community resources related to crime prevention, reporting resources and survivor assistance.

You may use the link below to access a digital copy of the current report. Paper copies of the current report are available free of charge and may be requested by emailing clery@berkeley.edu.