-

-

- Transfer Credit

- Online Learning

- Events

-

-

-

- Academic Services

- Course and Program Information

- Student Aid

-

-

-

Berkeley Global

Why Does UC Berkeley Extension Need My Individual Taxpayer Identification (ITIN) or Social Security Number (SSN)?

Below are many of the frequently asked questions we get about this topic. If you have a specific question that you cannot find in this document, please email the UC Berkeley Extension Registrar’s Office at extension@berkeley.edu. It will take two to three business days for a response.

Is this email notice spam?

No. UC Berkeley Extension is required by the IRS to send you this reminder about your responsibility to keep the University's records current.

Is this email notice a phishing attempt?

No. The message advises you not to send personal information by email. If you are uncomfortable about clicking on a link in an email, then type the Web address into your browser or search the IRS or UC Berkeley Extension website directly.

Can you please remove me from your mailing list?

No. This is an administrative email and notice from the University.

You are receiving this notice because the IRS requires UC Berkeley Extension to request this information from students who had a reportable transaction (such as a tuition payment or program application/registration fee) in tax year 2024. If you did not have a reportable transaction in 2024, please disregard this email.

What is my Individual Taxpayer Identification Number (ITIN)?

Your ITIN = your Social Security Number (SSN). If you are not eligible for a SSN and you have an ITIN instead, then update your student account with your ITIN.

What is an IRS Form 1098-T?

The IRS Form 1098-T is a tuition statement used to assist the taxpayer in determining eligibility for an educational tax credit and/or deduction. The IRS requires that the University issue a Form 1098-T Tuition Statement to every student who has a reportable transaction (such as a tuition payment or program application/registration fee) in the tax year 2024.

How is this notice relevant to an international student?

If you have obtained an SSN or ITIN, then this notice is a reminder to update your student records with this information. All U.S. citizens, resident aliens and nonresident aliens who had at least one reportable transaction and who intend to or who will file a U.S. tax return for the purpose of receiving an educational tax credit need to provide this information to the University.

If I am an international student and I do not have a SSN/ITIN, what do I do?

If you are a nonresident alien, do not have an ITIN and do not intend to file a U.S. tax return, then please disregard this notice. You are not required to supply this information to the University, and this solicitation does not affect your enrollment status or studies at UC Berkeley Extension.

If I am an international student, should I obtain an ITIN?

You should consult with your tax adviser or ask the IRS. If you decide to apply for an ITIN, follow the instructions in IRS Form W-9S under "How to get an SSN or ITIN."

Refer to the IRS website for more information about Individual Taxpayer Identification Numbers.

Is this ITIN requirement something new?

No. A similar "SSN required" notice is included on all UC Berkeley Extension enrollment forms and also included under My Profile on your student account. The IRS has required an ITIN for tax reporting since 1996. Please refer to "Do I Need One?" on the IRS Taxpayer Identification Numbers page.

Don't you have my name/ITIN information already?

It is possible that UC Berkeley Extension may have your name/ITIN because we request it every time a student opens an account on our website and when students enroll by other means; however, the University has no way to determine if that information was erroneous or has changed. Also, once you create your student account, you cannot change your name online and must follow the solicitation instructions. As the individual to whom an ITIN was issued, you are the best person for keeping your student records up to date.

Why would my name/ITIN in UC Berkeley Extension’s records be erroneous or require a change?

A life event may necessitate an update. For example, your name may change by marriage, or your ITIN may change with your immigration status. The name/ITIN might have also been entered incorrectly when you opened your student account.

An IRS audit may uncover a discrepancy between the information on your return and the name/ITIN you provided to UC Berkeley Extension, so it is important for you to verify this information.

How is this notice relevant to someone who is no longer studying at UC Berkeley Extension?

Even if you are no longer enrolled, UC Berkeley Extension will issue you a Form 1098-T if you had at least one reportable transaction during tax year 2024. You are responsible for keeping the University's records current.

I don’t want to report my ITIN/SSN to UC Berkeley Extension, but I still want an IRS Form 1098-T to be issued to me. Is that possible?

Regardless of whether you decide to respond to the University’s solicitation for your SSN/ITIN, the IRS requires that the University issue a Form 1098-T to every student who has a reportable transaction in the tax year 2024. You can choose to retrieve your Form 1098-T each year by using your student ID (instead of your ITIN/SSN) to log in at http://www.tsc1098t.com.

Will I be penalized for not reporting this information to UC Berkeley Extension?

The IRS has informed us that it is possible you could be penalized for failing to supply the University with your SSN/ITIN. For more information, consult your tax consultant, tax accountant or the IRS.

I will be reimbursed by my employer for my courses. Do I still need to supply my SSN/ITIN to the University?

If you paid the University directly for a reportable transaction, the University will still issue you an IRS Form 1098-T and the request to provide the University with an SSN/ITIN is still applicable to you. However, because you were reimbursed, you may not be eligible for education tax credits. Please consult a tax consultant, a tax accountant or the IRS for more information.

My parents do my taxes; why don't you ask them for my name/ITIN?

As the student, you are the responsible individual. You are the only person who can update your UC Berkeley Extension student records.

Is this notice going to affect my financial aid/assistance?

The ITIN you supply to the University for financial aid or private financial assistance may be used to verify your identity and to update your student account. It may also be included on your IRS Form 1098-T (Tuition Statement).

If you are a student in the Fall Program for Freshmen, your IRS Form 1098-T (Tuition Statement) will be issued by Billing and Payment Services on the main campus. The University may use the ITIN on file in the Financial Aid Office from the Free Application for Federal Student Aid (FAFSA) to include on your IRS 1098-T (Tuition Statement). If you have been informed about a name/ITIN issue by the Financial Aid Office, then follow up with that office as directed.

Does any other resource have my name/ITIN on file?

If you previously received a Form 1098-T from UC Berkeley Extension, then you have an account at the TAB Service Company (TSC). The University of California has contracted with the TAB Service Company (TSC to electronically produce your IRS Form 1098-T Tuition Statement. You can try logging in with your ITIN at the TAB Service Company website at www.tsc1098t.com. (For login assistance, call toll-free 888/220-2540.) If you are able to log in, then you have an indication that the name/ITIN matched for your last 1098-T.

Only you can judge if your information has changed since the last time you received a Form 1098-T. That is why the University has requested your cooperation with the ITIN notice.

How and when will I receive my Form 1098-T Tuition Statement for tax year 2024?

If you had at least one reportable transaction during tax year 2024 and if UC Berkeley Extension has a current and valid email address on file for you, you will receive an email notification from UC Berkeley Extension by Jan. 31 each year to inform you that your 1098-T is available online at www.tsc1098t.com.

Be sure your spam filter does not capture email from "UC Berkeley Extension. If you do not receive a 1098-T notification via email by Jan. 31, 2025, please log in to www.tsc1098t.com and enter the following information to login:

- Enter the Site ID: 5 digit school code assigned by Tab Service = 11554

- User Name: Student ID that starts with X

- Password: Last 4 digits of your SSN

If you are an international student without an SSN or have otherwise not provided your SSN to UC Berkeley Extension, the temporary password will be 0000. Submitting this temporary password in the login screen will initiate a password reset process with your email on file.

For security reasons, you will then be prompted to change your password. Enter your old password (last four digits of your SSN) and then enter a new password. The new password must be 7 characters and contain at least one numeric character, one upper case letter and one special character.

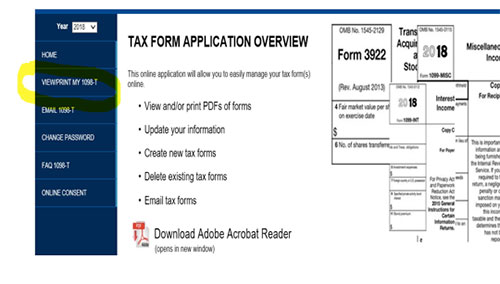

Once you login to the website, you can access and print your 1098-T form by selecting “View/Print My 1098-T” from the menu on the left side of the screen.

If you need assistance, please call 888-220-2540.